How to File a Rental Car Insurance Claim: A Complete Guide

Overview

Rented a car abroad and got charged for damage? This guide walks through the entire process of filing a claim with third-party rental car insurance providers (such as RentalCover, WorldNomads, or similar services).

Why third-party rental car insurance?

| Rental Company Insurance | Third-Party Insurance |

|---|---|

| Expensive (€15-30/day) | Affordable (often <€10/day) |

| Limited to one rental | Usually covers multiple rentals |

| Automatic deduction | Reimbursement-based |

Third-party insurance typically covers the excess/deductible charged by rental companies for damage, theft, or single-vehicle accidents — at a fraction of the cost.

Part 1: Essential Documents (The “Big 5”)

Before starting the claim form, gather these five documents in digital format (PDF or clear photos):

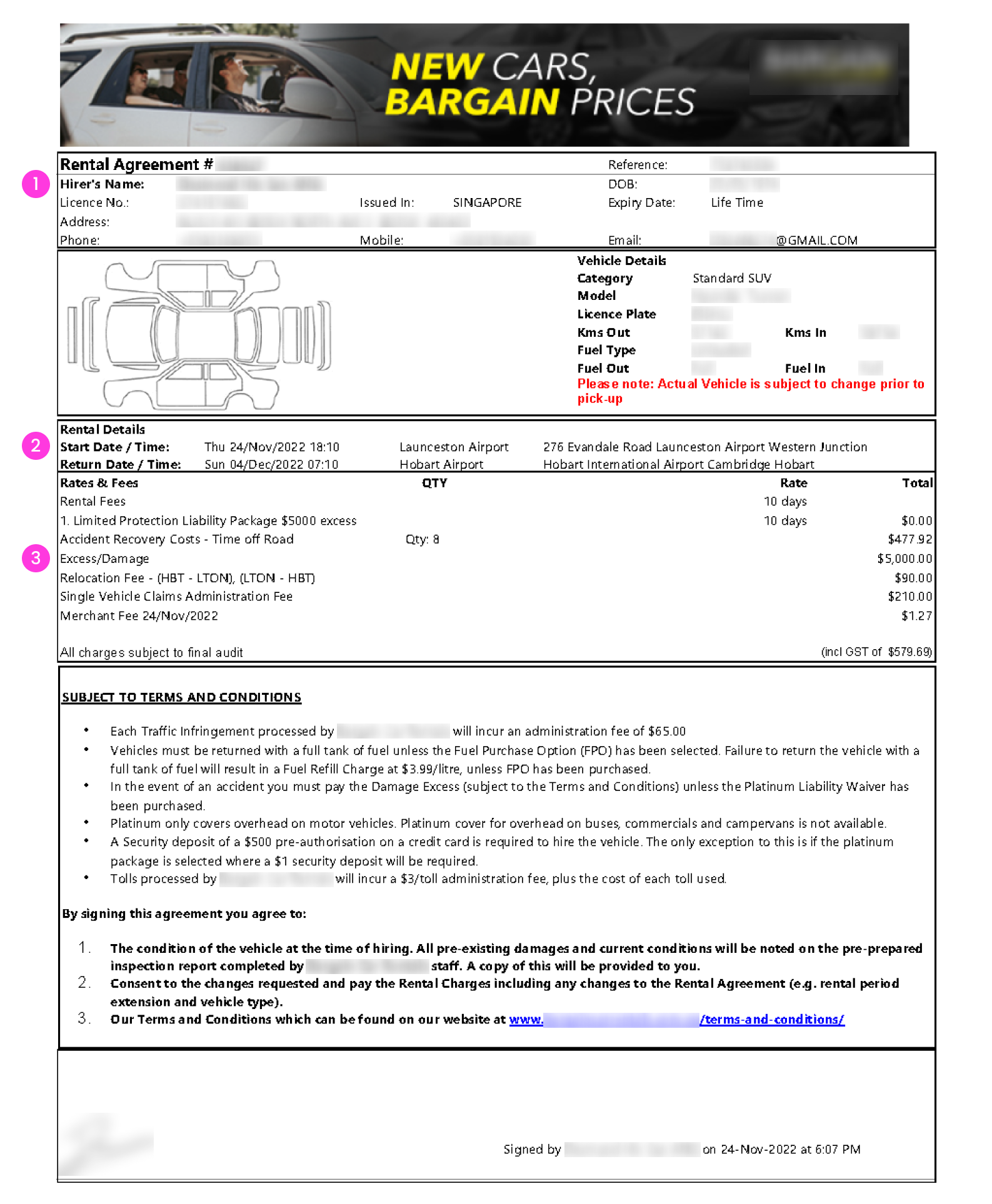

Rental Agreement / Contract

The document signed at pickup, containing:

- Primary driver’s name

- Rental period

- Excess/deductible amount (crucial!)

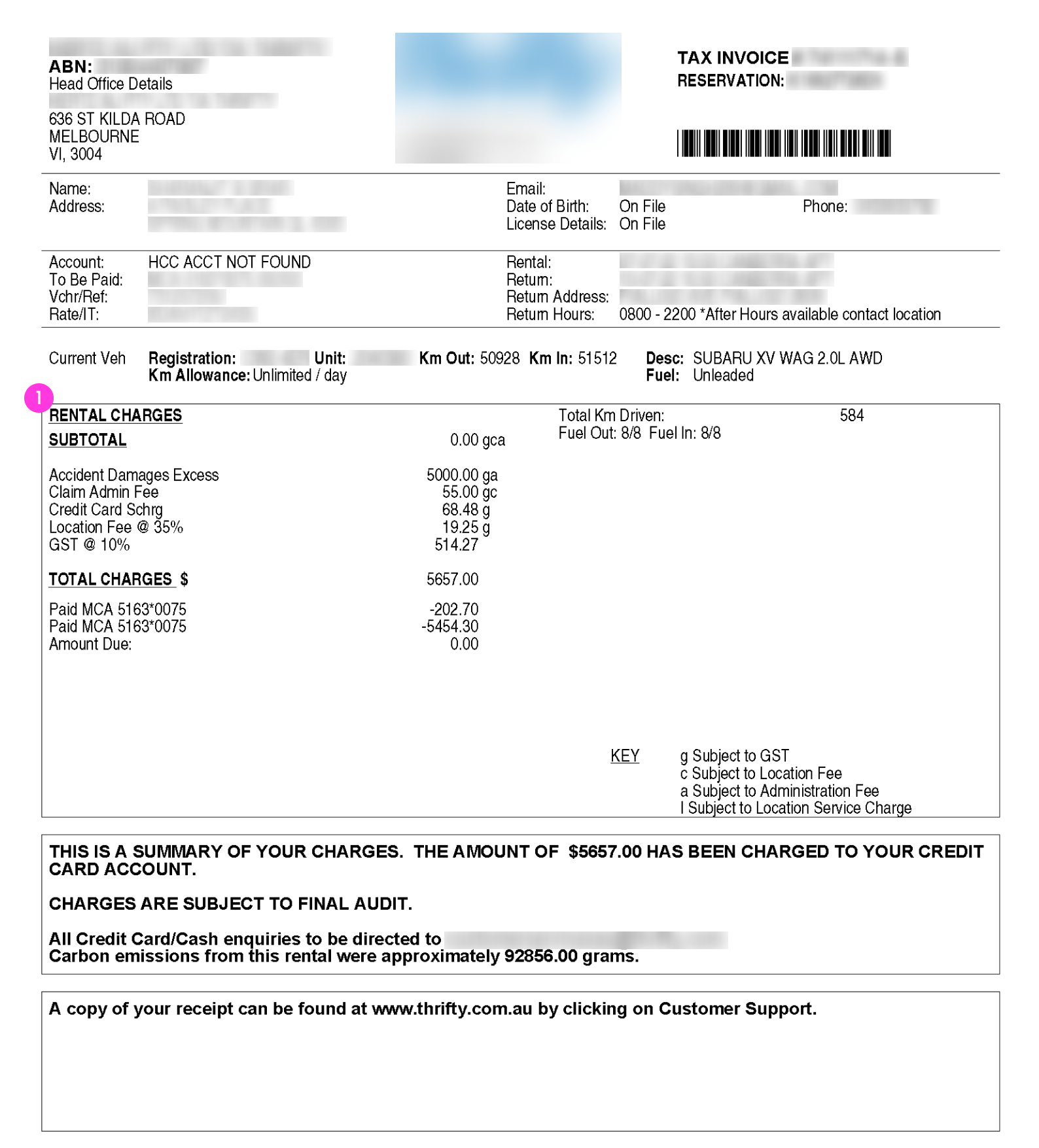

Final Invoice

The billing document issued after returning the vehicle:

- Must show the exact repair/damage charge (e.g., €490)

- Different from the initial rental quote

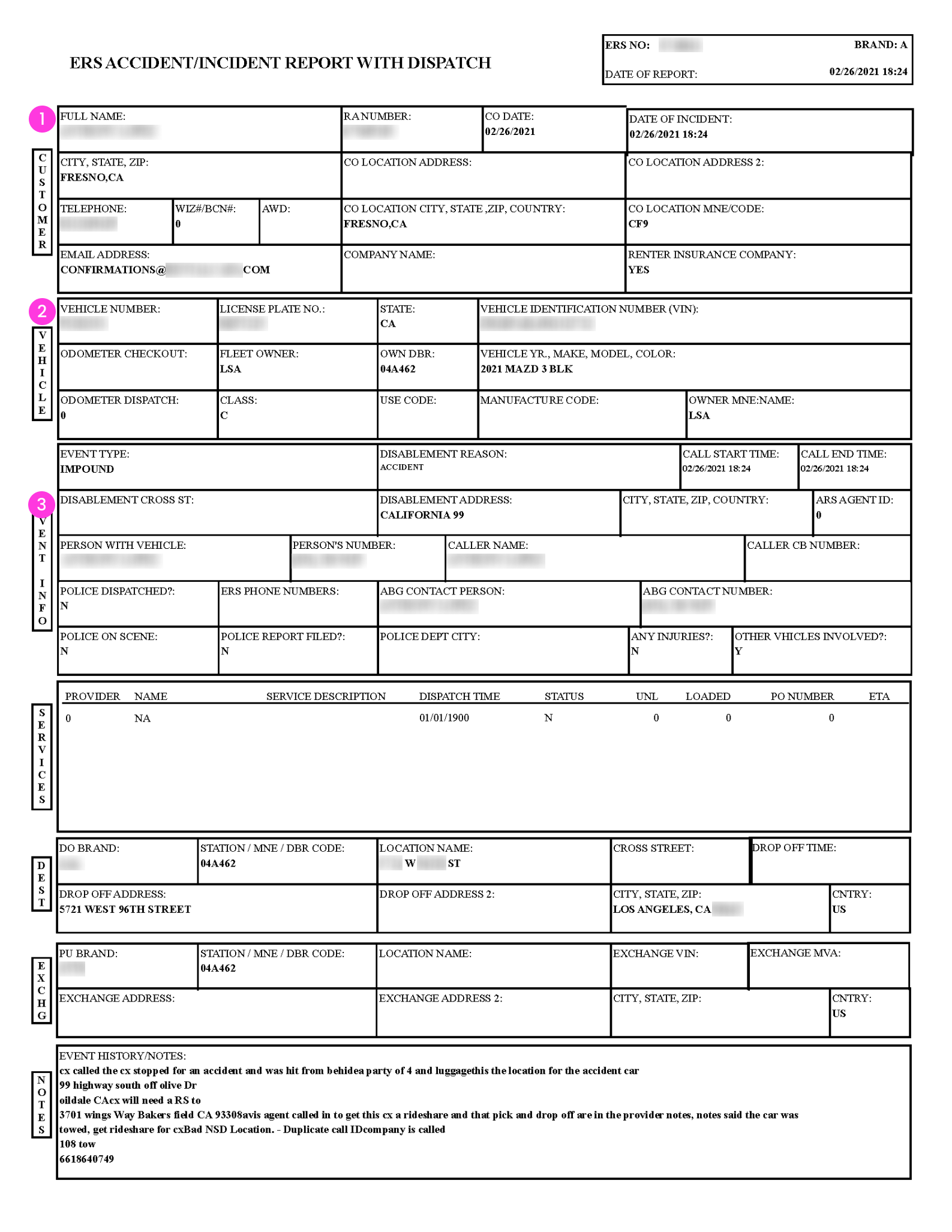

Damage Report / Check-out Form

The inspection form at vehicle return:

- Contains staff markings indicating damage location

- Core evidence that damage was acknowledged by the rental company

Proof of Payment

Credit card statement or bank transaction:

- Proves the amount was actually deducted from the account

- Screenshot showing date, amount, and merchant name

Photos of Damage

Pictures taken at the scene:

- Close-up shots of scratches, dents, or other damage

- Include wide shots showing the damage location on the vehicle

Part 2: Filling Out the Claim Form

Selecting Cause of Damage

Choose based on when the damage was discovered, not when it occurred:

| Scenario | Recommended Selection |

|---|---|

| Discovered during return inspection | “The incident happened while the vehicle was unattended” |

| Notified after leaving (email/charge) | “I found out about the damage after returning the vehicle” |

Writing the Description

Use clear, factual language. Template:

“During the vehicle drop-off inspection, the rental company staff pointed out a new scratch/dent. I was not aware of this damage previously. The staff suggested it was likely caused by another car door hitting the rental vehicle while it was parked and unattended. I do not have details of the third party.”

Rental Agency Information

| Field | What to Enter |

|---|---|

| Agency Name | The actual car rental company (e.g., Hertz, Avis, Europcar) — not the booking platform |

| Agency Email | The rental company’s email (found on the contract header/footer) |

Claim Amount

| Field | Value |

|---|---|

| Total amount claiming | The actual charge deducted (from final invoice) |

| Damage Protection Excess | The maximum excess stated in contract (typically €1,000 - €1,500) |

Part 3: Common Pitfalls to Avoid

⚠️ Name Consistency

For fastest processing, ensure these three names match:

- Claim applicant name

- Primary driver on rental contract

- Credit card holder

⚠️ Police Report

For minor incidents (scratches, glass, tire damage) with:

- No injuries

- No third-party dispute

A police report is not required. Select “No” when asked.

⚠️ Timeline Logic

- Incident date cannot be after vehicle return date

- If unsure when damage occurred, use the return date or day before

⚠️ Bank Details

- Not required at submission time

- After approval, the insurer sends a secure link to collect payment information (IBAN)

Part 4: After Submission

Timeline

| Stage | Expected Duration |

|---|---|

| Initial review | 3-7 business days |

| Additional documents (if needed) | Check email including spam folder |

| Payment processing | 1-3 days after approval |

Payment Process

- Receive “Claim Approved” email

- Click the secure link in the email

- Enter bank account details (European IBAN recommended for fastest transfer)

- Wait for funds to arrive

Summary Checklist

Before submitting, verify:

- All 5 essential documents uploaded

- Rental company name (not booking platform) entered

- Claim amount matches final invoice

- Incident date is before or on return date

- Description is clear and factual

- Names are consistent across documents